News and events

API Standards for DFM Portfolio Management

Criterion invites industry participation in work to assess how data integration (API) Standards could help reduce friction and costs arising from processes between Discretionary Fund Managers (and other firms that offer managed portfolio services) and investment platforms when maintaining model portfolios.

DFMs devise model investment portfolios, that require rebalancing from time to time to compensate for drift from the model; but the processes followed to do so are a source of friction, risk and cost.

Criterion will work with stakeholders in these processes, drawn from investment platforms, DFMs and their respective software and service providers, to define a common understanding of the processes in question and their associated issues; to identify the extent to which Standards-based APIs could help to resolve those issues; and to assess industry appetite for realising those improvements.

Risk and friction in managing model portfolios

DFMs devise model investment portfolios, designed to meet the needs of investors with a range of risk appetites, ethical and religious requirements and investment horizons. These are made available to the market through investment platforms, through which advisers and their clients can place investments conforming to those models.

Over time, however, variations in performance mean that the investments made by clients drift with respect to the model. DFMs periodically rebalance those investments in order to bring them back in line, but the interactions between DFMs and investment platforms to do so generate process friction in two areas:

- DFMs need Management Information (MI) about investment performance from platforms in order to calculate the trades required to effect that rebalancing. There is no consistent presentation of data or process to obtain it across advised platforms, generating an overhead for DFMs.

- DFMs then need to instruct the trading required by the platform to bring client investments back into line with the model. This is generally done by keying calculated trades into platform user interfaces (UIs).

That generates risk, and the costs associated with ‘four eyes’ processes to mitigate them.

How Standards-based data integration can help

Providing DFMs with a consistent MI data set will help to streamline the analysis that they need to perform in respect of each platform where their model portfolios are available; and delivering a consistent way of specifying trades that – critically – avoids any need for manual re-keying will not only streamline those processes but also help to manage down the associated operational risks and mitigation costs.

Investment platforms will benefit as well. Onboarding DFMs who are familiar with an industry-Standard approach to managing model portfolios will be easier and less risky for platforms that support them. Moreover, platforms who support industry-standard portfolio management will be more attractive to DFMs, extending the reach of the platform’s proposition.

And both sides will benefit from a solution model that does not interpose a third party between the DFM and the platform, meaning that the existing liability model, based on two parties, can continue.

Why Standards for APIs?

API technologies have contributed to an explosion in data integration, making it easier and quicker to accelerate business processes by getting the right data to the right place at the right time; and technologies like JSON and OpenAPI have made development and deployment of APIs simpler than ever.

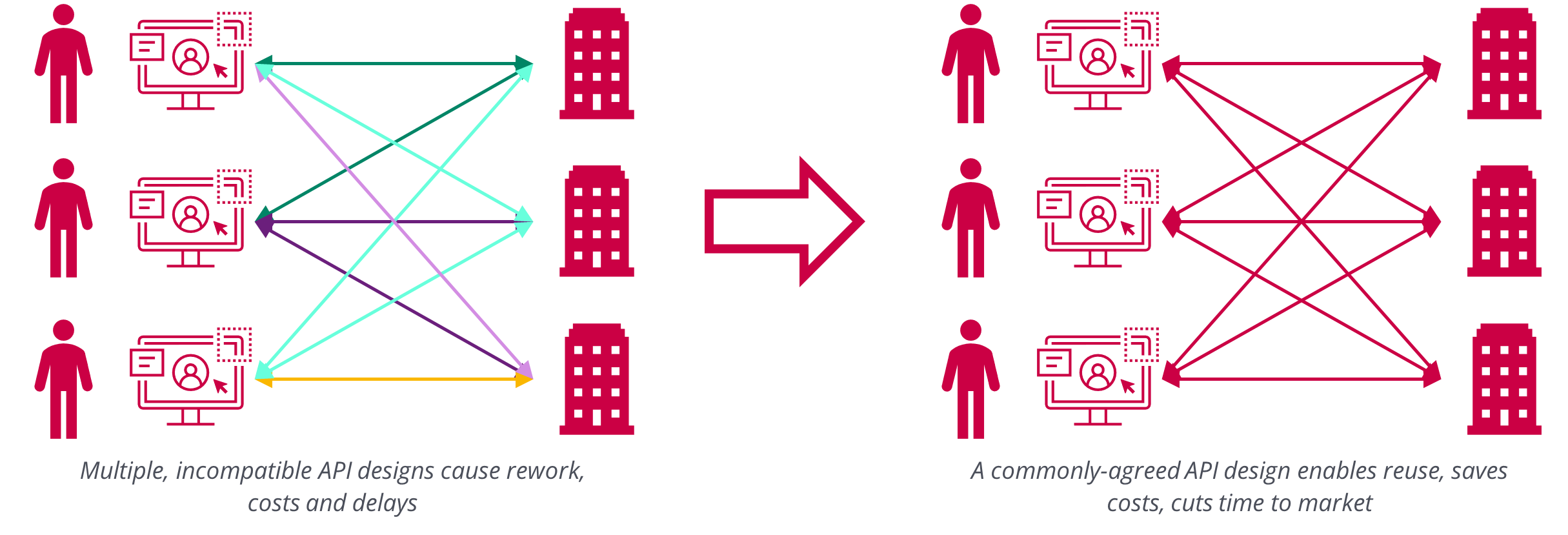

But that doesn’t mean that duplication and waste have become any more desirable: it’s still quicker and more cost-effective to build a service once and deploy it with many trading partners than it is to rebuild and refine it time after time to meet their differing needs.

That’s where Criterion Standards come in. Criterion’s unique approach to collaboration, refined and proven for than 30 years, delivers solutions that are specified, designed and approved by subject-matter experts from across the industry. All of that industry expertise is baked into API Standards, giving organisations confidence that Standards based integration will be straightforward to deploy with trading partners and will fit the need that it is designed for.

The result is that an API build can be deployed with many trading partners, cutting out wasteful redevelopment.

About Criterion

Criterion is the not-for-profit body that delivers Standards for process and data integration, making it easier for companies in the UK Financial Services industry to work together to serve customers better.

Criterion manages a suite of more than 70 Standards for API design and implementation, covering data integration points between organisations in the protection, pensions, retirement and investment sectors. Criterion Standards are relied on by more than 100 manufacturers of protection, pensions, retirement and investment products. Our API Standards support more than half a billion business-critical quotation and valuation transactions each year, whilst over the last decade the Common Declarations have helped take more than 400,000 years’ worth of delays out of pension transfers for consumers.

Next steps

Criterion invites engagement from as broad a cross-section as possible of stakeholders in DFM Portfolio Management processes.

To find out more about taking part, contact:

- Nick Green, Solutions Director, [email protected] | 07990 586832