News and events

API Standards for Letter of Authority processes

Criterion is developing a series of API Standards to support the digitisation of Letter of Authority processes.

Getting accurate, up to date details of clients’ investments and policies is absolutely critical to the delivery of robust, high quality advice. Yet Letter of Authority processes rely on a huge amount of manual effort by both advisers and providers to navigate a wide variety of approaches to request and authorisation. Response times and outcomes can also vary considerably from provider to provider.

Criterion is working with a wide range of providers, advisers and software suppliers to define a repeatable, standardised approach to these processes that can be implemented using API technology to deliver a reliable, easy-to-navigate experience that increases consistency; reduces time, effort and costs; and – critically – supports delivery of better outcomes for customers.

Why Standards for APIs?

API technologies have contributed to an explosion in data integration, making it easier and quicker to accelerate business processes by getting the right data to the right place at the right time; and technologies like JSON and OpenAPI have made development and deployment of APIs easier than ever.

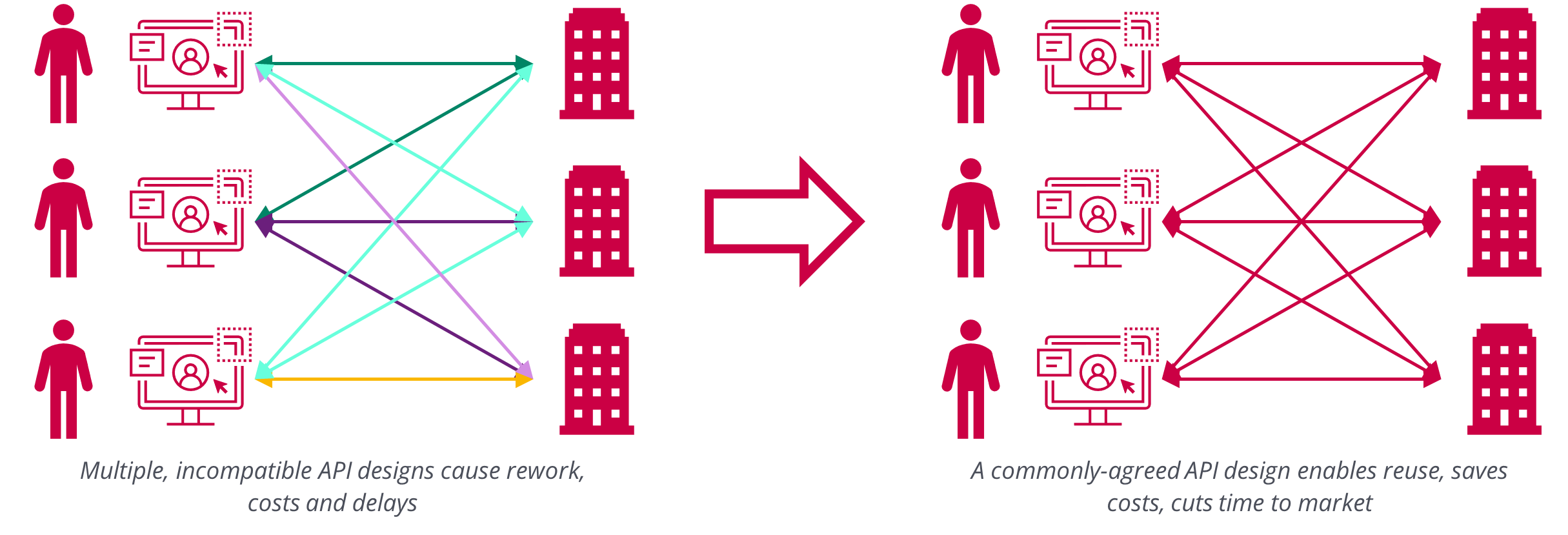

But that doesn’t mean that duplication and waste have become any more desirable: it’s still quicker and more cost efficient to build a service once and deploy it with many trading partners than it is to rebuild and refine it time after time to meet their differing needs.

That’s where Criterion Standards come in. By working with key market stakeholders, Criterion defines Standards for APIs so that the data they contain, and how that data is structured and exchanged, meets the needs of the market as a whole. The result is that a single API build can be deployed with many trading partners, cutting out wasteful redevelopment.

The information you need for advice – right where you need it

Today, Letter of Authority information typically arrives in one of a range of unstructured formats – letters, emails, PDFs, faxes – from which key information needs to be extracted manually by the advice team for use in analysing the client’s situation using advice tools like client management systems, portfolio or fund x-ray, cashflow modellers and needs calculators. That is costly, and runs the risk of rekeying errors.

Our API Standards are a blueprint for integration that can deliver that critical key information in a structured way, meaning that it can be consumed and processed directly by adviser software and then shared with relevant tooling, without the need for manual keying.

A solution designed and managed by the industry for the industry

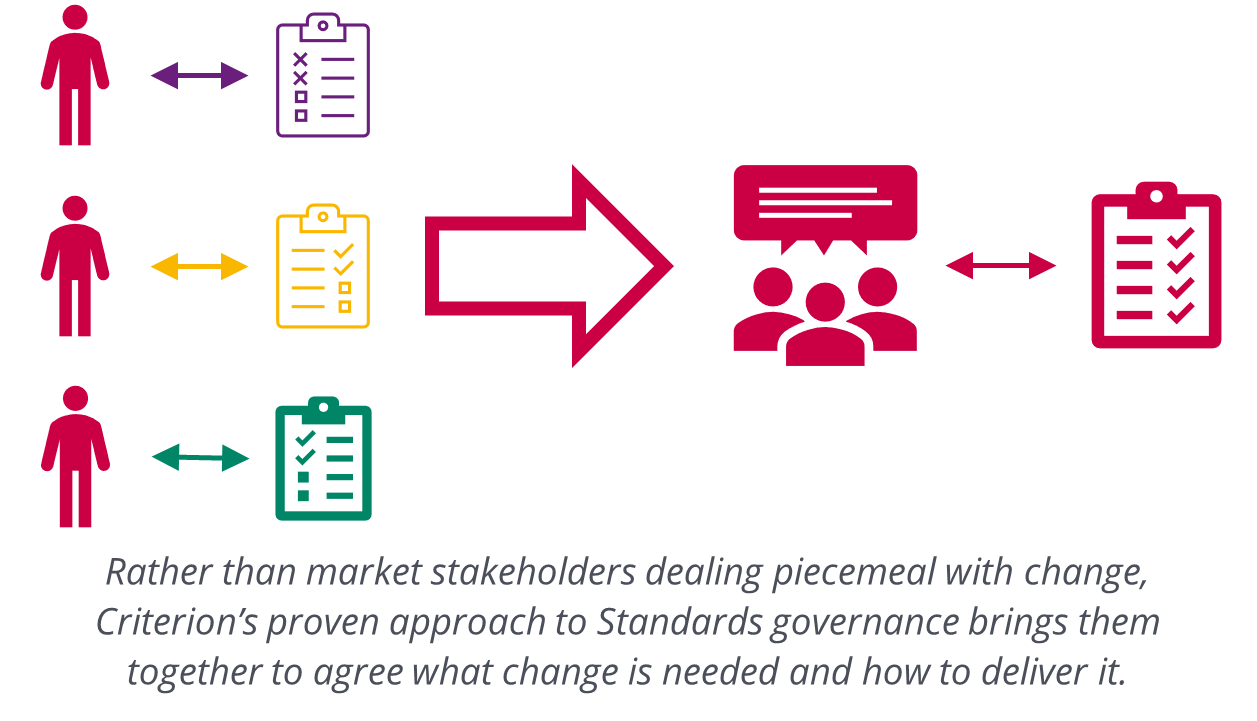

Criterion’s unique approach to collaboration, refined and proven across more than 30 years, delivers solutions that are specified, designed and approved by subject-matter experts from across the industry.

All of that industry expertise is baked into our API Standards, giving organisations confidence that Standards-based integration will be straightforward to deploy with trading partners and will fit the need that it’s designed for.

We keep that collaborative approach going into the long term, working with those same experts to ensure that our API Standards keep pace with market innovation, consumer trends and the regulatory environment.

About Criterion

Criterion is the not-for-profit body that delivers Standards for process and data integration, making it easier for companies in the UK Financial Services industry to work together to serve customers better.

Criterion manages a suite of more than 70 Standards for API design and implementation, covering data integration points between organisations in the protection, pensions, retirement and investment sectors. We also support and manage other pieces of key collateral that simplify and remove friction from industry processes, including:

- Criterion Common Declarations, which eliminate discharge forms from pensions transfers.

- Retirement Health Form, which helps retirees get right-first-time quotes for enhanced annuities.

Criterion Standards are relied on by more than 100 manufacturers of protection, pensions, retirement and investment products. Our API Standards support more than half a billion business-critical quotation and valuation transactions each year, whilst over the last decade the Common Declarations have helped take more than 400,000 years’ worth of delays out of pension transfers for consumers.

Find out more

Our team is always keen to talk about our Standards and Governance work, whether you need support for detailed implementation planning, or just want to learn more about who we are and what we do.

To find out more, contact:

Nick Green Solutions Director

[email protected] | 07990 586832